What kind of real estate to invest in?

Investors buy property in Malta to rent it out, make a liquid asset investment, spend vacations in the country, or get a residence permit by investment.

Residential property prices in Malta grow by 3—6% a year, according to Eurostat estimates. Some properties grow in price faster, depending on the type. For example, modern business-class apartments become 18—25% more expensive annually at the construction stage and about 10% more expensive afterwards.

Maximum income is generated through investments in new residential real estate in Malta. Buying a property at the development stage is the most profitable — the price can grow twice as fast as the price of the finished property.

Rental income in Malta ranges from 3.5 to 6% a year.

The most uncomplicated purchase procedure for foreigners is conducted in Special Designated Areas (SDAs). Within these zones, investors can acquire real estate without the need for a special permit. They are also allowed to buy multiple properties simultaneously and consider renting them out. The range of real estate options is diverse, including apartments, penthouses, duplexes, and villas.

Here are notable Special Designated Areas in Malta:

- Tigne Point;

- Southridge Modern Living in Mellieha;

- Manoel Island Development;

- Fort Cambridge;

- The Shoreline at SmartCity;

- Portomaso Development;

- Fort Chambray;

- Vista Point;

- St Angelo Mansions;

- Pendergardens;

- Ta’ Monita Residence;

- Madliena Village Complex;

- Tas-Sellum Residence;

- Kempinski Residences.

SDA residential complexes are equipped for comfortable living, with shops, beauty salons, restaurants, swimming pools, gyms, and other amenities. Public transport stops are near the complexes. Residents can usually reach schools, hospitals, and major shopping centres in 15—20 minutes on foot.

Examples of Malta properties with prices

If a foreigner wants to buy property outside Malta’s SDAs, they need to get an Acquisition of Immovable Property (AIP) Permit. With this permit, investors can only buy one property in which they will live: it cannot be rented out.

An AIP permit is also required for citizens of Malta or other EU countries who have spent less than five years in the country and now buy their second residential property.

Due to the difficulties with AIP, properties outside the SDAs are not in demand among foreigners. Thanks to the simplified purchase procedure, properties in the SDAs increase in value two times faster than Malta real estate market properties on average.

Terms of buying property in Malta for foreign investors

| Procedure | SDAs | Outside SDAs |

| Getting an AIP permit | Not required | Required Issuance fee — €233 |

| Number of properties that can be purchased | Not limited | One property |

| Renting out | Allowed | Not allowed |

| Purchase registration period | 2—3 months | 4—6 months |

Step-by-step procedure for buying a property in Malta

You can buy a residential property in Malta with the help of a realtor or a licensed agent of residence-by-investment programs, such as Immigrant Invest. Lawyers in our Maltese office represent investors’ interests during real estate transactions on a power of attorney basis.

A notary must accompany the buying and selling of real estate in Malta. They act as an intermediary between the buyer, seller and government agencies. A notary draws up purchase permits and sales agreements, helps with fee payments and checks any potential risks for the buyer.

A notary draws up a preliminary purchase agreement. The agreement specifies the cost of the property, the deposit amount, the purpose of the purchase, and the repair works that the seller must perform.

The parties sign a preliminary contract, and the buyer makes a 10—15% deposit of the property’s price.

The notary informs the Ministry for Finance of Malta about the upcoming transaction and prepares the final purchase agreement. The Ministry registers the transaction and, if necessary, issues an AIP property.

The buyer and the seller sign the final purchase agreement. The investor pays the remaining sum, as well as associated taxes and fees.

The notary submits the final purchase agreement to the Public Registry of Malta. The investor or their representative registers the property in the Land Registry and receives the certificate.

Peculiarities of buying a property in Malta. Buying residential real estate in the country on your own is challenging. Advertisements on real estate websites in Malta are often irrelevant. Sellers are likely to choose buyers from the EU since closing the deal with them may be faster than with third-country citizens.

Buying property through a solo real estate agent is risky. They can name an inflated price and conceal construction violations or issues with documents.

When buying real estate with the help of Immigrant Invest, lawyers, a trusted agent, and a notary accompany an investor at every stage. The buyer does not need to go to Malta. A property can be selected online, and the documents can be issued via a proxy.

Expenses for property buyers in Malta

When completing the transaction, the buyer pays up to 16% of the property value as taxes and fees.

Fees when buying a property:

- Notary fee of 1—3% of the property value and VAT of 18% of that amount.

- Agency fee of 1.2% of the property value and VAT of 18% of that amount if the property was chosen via a solo real estate agent. This fee is not required if the buyer turns to a licensed agency.

- AIP permit — €233. A permit is not required if the investor buys a property in an SDA.

- Architect’s valuation — €300.

Taxes in Malta when buying a property:

- Stamp duty is 5% of the transaction value. It is paid once when the purchase agreement is signed. There is no annual property tax in Malta.

- Tax for the land on which the property is located. It is paid if the land is under a long-term lease and is €40—250 per year.

How much to invest in real estate

Apartments in SDAs usually cost €2,000 to 6,000 per 1 m². If you invest a certain amount in Malta real estate, you can get either permanent residence or citizenship by naturalisation for exceptional services by direct investment.

Investors with Malta permanent residence cards can visit the Schengen Area without a visa. Investors with Malta passports can enter 169 countries without a visa, including the US, the UK, Canada and Australia. They can also live and conduct business in Malta.

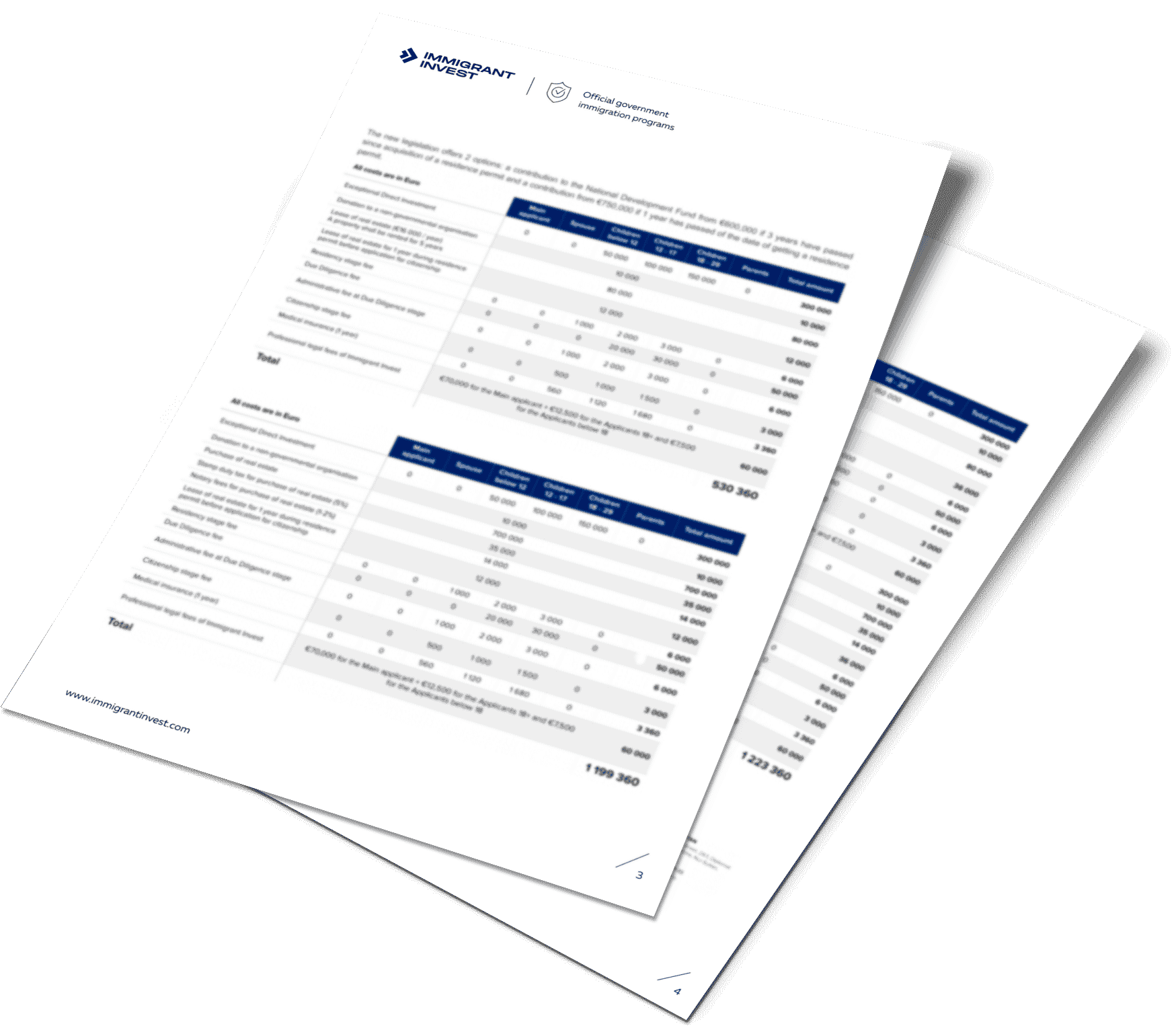

The minimum real estate investment threshold for getting a permanent residence is laid out in the Malta Permanent Residence Programme rules. The minimum investment threshold for obtaining citizenship is laid out in the Maltese Citizenship Act.

To get permanent residence, investors buy properties for at least €300,000 in the south of Malta and the island of Gozo or properties for at least €350,000 in other regions.

To apply for citizenship by naturalisation for exceptional services by direct investment, investors buy apartments and villas for at least €700,000.

5 benefits of buying property in Malta

1. Path towards investment programs. Purchasing real estate in Malta is one of the conditions for investors to apply for Malta citizenship by naturalisation for exceptional services by direct investment or Malta permanent residence by investment.

2. The ever-growing real estate market. The Maltese residential property market has witnessed a 28% increase in prices from 2017 to 2022, indicating a steady growth trend. This consistent upward trajectory suggests that investing in Maltese property is likely to be financially beneficial in the long run.

3. A safe haven in the Mediterranean. Acquiring property in Malta and subsequently becoming a citizen or resident allows unrestricted access to the country. Investors can visit, reside, or stay indefinitely, enjoying the benefits of a Mediterranean lifestyle.

4. High safety standards. Malta was ranked among the top 15 safest countries in the world in 2023 by Insurly, an insurance company. This high safety rating, coupled with low crime levels, ensures that investments in Maltese real estate are secure.

5. Possibility of returning the investment. Real estate owners who become Malta citizens or permanent residents can return the investment after 5 years of ownership.

Best cities to purchase real estate in Malta

Most investors choose real estate in the north of the country because the demand is higher than for properties in other regions. It is easier to rent it out or resell it.

Cities with SDA properties boast developed infrastructure due to popularity among foreign buyers. These are primarily cities in the Northern and Southern Regions. Branches of UK and US schools and universities, renowned language schools, and large clinics are concentrated in the north of Malta.

St Julian’s is a resort town in the Central Region of Malta. Expats from the EU and the UK choose it often, especially those employed in the IT field. St Julian’s is one of the most expensive places in the country, but it is perfect for socially active people. Average property prices there start at €2,350 per 1 m².

Marsascala is a charming old town at the bay in the southeastern region of Malta. A former fishing village, it has evolved into a thriving modern hub for natives and expats. Life there is never rowdy but never dull due to a well-developed infrastructure and multiple options for work and leisure. Average property prices in Marsascala start at €1,750 per 1 m².

Sliema is another well-known Maltese resort town located in the Central Region. It is less busy than the neighbouring Valletta and St Julian’s but is still vibrant and energetic. The main buzz is concentrated on the southern coastline of the town, where tourists and weekend crowds usually go. The northern part of Sliema is quieter and offers numerous seaside properties with breathtaking views. Average property prices in Sliema start at €4,000 per 1 m².

Gozo is an island of 67 km² and a part of the Republic of Malta. Several cities there have SDA complexes with a large variety of apartments, namely, Marsalforn, San Lawrenz, and Ghajnsielem. Gozo is suitable for a comfortable yet more laid-back lifestyle and is perfect for nature lovers. The neighbouring islands of Comino and Malta can be reached by ferry. Average property prices in Gozo start at €1,662 per 1 m².

In recent years, the country’s government has been actively attracting investment to the southern regions and the island of Gozo. There is a chance that in 10 years, property prices will be increasing there as fast as in the north.

Investors can sell an apartment in Malta in five years after obtaining permanent residence or citizenship and make a profit due to rising property prices. The reselling will not affect their status in Malta: it is retained for life.

Each investor’s spouse, children, parents, and grandparents can get Malta permanent residence, too. It is allowed to add a spouse, children under 29, and parents and grandparents over 55 to a citizenship application. In both cases, all adult family members except the spouse must be principally dependent on the investor.

How do investors with Malta permanent residence or citizenship confirm property ownership?

Investors who have purchased a property to participate in the Malta Permanent Residence Programme or get citizenship by naturalisation for exceptional services by direct investment are required to hold it. The minimum holding period is 5 years from the status acquisition date. If they sell the property earlier, they can lose their permanent residence or citizenship.

To confirm the conditions are met, investors present a purchase and sale agreement every year within the first five years. Permanent residence holders submit their agreements to the Residency Malta Agency, and passport holders submit them to the Community Malta Agency.

Immigrant Invest submits the required documents as a licensed agent of the Malta Permanent Residence Programme and Malta Citizenship by Naturalization for Exceptional Services by Direct Investment.

After the first five years, investors can sell the property. After that, they need to keep their registered address in Malta — to do that, they can buy another property or rent an apartment with no cost requirements.

Maintenance costs for property in Malta

The property owner regularly pays for utilities. Bills for an 85 m² apartment in Malta, such as electricity, water and garbage disposal, are about €95 per month. Utility bills for an apartment of a similar size would be around €130 in Spain and €110 in Portugal.

Apartment owners in SDA business-class complexes may spend about €3,500 per year on utilities.

Property owners also make annual homeowner insurance payments. The average yearly cost is €50—100 for an apartment and €500 or more for a house.

The ground rent tax is €40—250 per year. Owners pay it if the land on which the house is built is leased.

Owners who rent their property out pay income tax at a rate of up to 35%. Landlords can also apply for a reduced rental income tax rate of 15%.

Selling a property in Malta

An investor who owns a property in Malta can sell it to a citizen of any country. To do this, they find a real estate agent and supervise their work. As with the purchase, the sale transaction must be accompanied by a notary.

When selling real estate in Malta, the investor pays the tax:

- 5% if the property has been owned for less than 5 years;

- 8% if the property has been owned for more than 5 years.

In some cases, the investor pays an additional tax on income from the sale of real estate in the country of their first citizenship.

In addition to taxes, the seller pays the following fees:

- notary fee of 1—3% of the property value and VAT of 18% of that amount;

- agency fee of 1—5% of the property value and VAT of 18% of that amount.

The real estate department of Immigrant Invest helps investors buy properties that meet their needs. Our attorneys evaluate the transaction and assist with obtaining Malta permanent residence, as well as citizenship by naturalisation through exceptional services by direct investment.

In a nutshell: how to buy a property in Malta

The procedure for buying residential property in Malta will be the simplest if you buy an apartment or villa in one of the Special Designated Areas (SDAs). You won’t need a permit for the transaction in that case. Moreover, the investor can purchase several properties and rent the objects out.

It usually takes 2—3 months to buy a property in an SDA complex. To make a purchase, you need the help of a real estate agent or a licensed agent of the investment program. Participation of a notary is mandatory.

The investment property cost can grow by 18—25% per year if the SDA complex is located in the north of Malta and is under construction. If the property’s price is at least €350,000, the investor can obtain a Malta permanent residence permit.

Frequently Asked Questions

The annual growth of Maltese real estate prices is 3—6%. Properties located in Special Designated Areas (SDAs), which are subject to special conditions for foreign real estate investors, experience a faster rate of price appreciation — averaging an annual increase of 10%.

Under Malta’s permanent residence program terms, as well as Malta citizenship terms, the minimum holding period for investment real estate is 5 years.

Buying a property in Malta on your own is challenging. Website ads quickly become outdated. It is necessary to check the property’s compliance with building codes. In addition, realtors often name inflated prices, and problems with ownership documents are frequent. A licensed agent, such as Immigrant Invest, can help you select a property and verify the legal integrity of the transaction.

SDA residential complexes are where foreigners can buy real estate under a simplified procedure.

Unlike with other residential properties, foreigners do not need to obtain a special permit for €233 if they buy properties in an SDA. The process of buying an SDA property is two times faster.

We have put together information about maintenance costs and additional expenses in the detailed guide on buying real estate in Malta.

To get permanent residence in Malta, investors need to meet a number of conditions. These include buying or renting real estate in Malta.

The minimum real estate investment threshold is €300,000 if you buy a property in the south of Malta or on the island of Gozo. An apartment or villa in another region should cost at least €350,000.

Some investors enter into a long-term lease agreement instead of buying real estate. The minimum annual rent for obtaining permanent residence status is €10,000 if the property is in the south of Malta or on the island of Gozo. If the property is located in another region, the minimum annual rent is €12,000.

Malta has different conditions and prices for citizens and foreign investors who buy residential property in the country. When purchasing a property, an investor spends up to 16% on taxes and fees.

A residential real estate purchase process is always executed through a notary.

Residential property owners regularly pay utility bills and homeowner insurance.

Investors can sell their property only in five years if they participate in the Malta Permanent Residence Programme or get citizenship by naturalisation through exceptional services by direct investment. If they sell the property sooner, they will lose their status.

During that 5-year holding period, investors confirm their ownership every year.

A notary is required for the purchase and sale process. The notary monitors both parties during the preliminary and final purchase and sale agreements and then registers the transaction with the Ministry for Finance. When the transaction is closed, the notary submits the final purchase agreement to the Public Registry of Malta.

Investors pay income tax if they sell their property. The rate depends on how long the investor has owned the property.

Investors can sell their property only in five years if they participate in the Malta Permanent Residence Programme or get citizenship by naturalisation through exceptional services by direct investment.

Yes, it is possible to buy property in Malta as a foreigner under particular conditions. The most convenient way to purchase property is to do that in Special Designated Areas, as the process will be faster and cheaper than if they try to buy real estate elsewhere in Malta.

Foreigners who buy real estate worth at least €300,000 in the south of Malta and the island of Gozo or €350,000 in other regions become eligible for the Malta Permanent Residence Programme.

Buying property in Malta could be a good investment for someone who wants to apply for permanent residence or citizenship for exceptional services by direct investment. It could return a solid profit to investors as the house prices in Malta are projected to grow steadily for the next five years.

House prices in Malta can vary between €2,000 and €6,000 per 1 m², depending on the location of the property. Besides, there are other associated fees and taxes, including a tax for the land on which the property is located.

Igor Buglo

Head of the Maltese office, MBA

Igor Buglo

Head of the Maltese office, MBA