Comparing citizenship and residency in Malta: an overview

We will compare the Digital Nomad Visa, residence permits, permanent residency, and citizenship in Malta. A Malta passport grants more rights and benefits than any residence permit but requires meeting more stringent criteria.

Relocation to Malta is feasible under all statuses, though the degree of flexibility varies.

Malta citizenship and permanent residency offer the most freedom, allowing individuals to choose the duration of their stay both in Malta and abroad without constraints. Conversely, temporary residence permit holders and digital nomads face specific limitations.

Investors holding temporary residence permits must not spend 183 days per year in any other country but for Malta to retain their status. Digital nomads are required to spend a minimum of five months annually in Malta to keep their status valid.

Visa-free travel. Holders of a Maltese passport can enjoy visa-free travel to 169 countries. In contrast, those with a temporary or permanent residence permit, including the Nomad Residence Permit, are limited to visiting the Schengen Area, where they can stay for up to 90 days within any 180-day period.

The validity period for both the residence permit and the Digital Nomad Visa is limited; they are initially issued for one year and may be extended.

Conversely, investors granted permanent residence or citizenship enjoy these statuses for life. However, permanent residence cards require renewal every 5 years, and the validity of Maltese passports ranges from 2 to 10 years, depending on the holder's age.

Investment thresholds vary depending on the type of application: renting real estate lowers the required investment. The starting expenses are €35,000 for a residence permit, €150,000 for permanent residency, and €690,000 for citizenship.

Digital Nomads are exempt from investment requirements but must demonstrate a minimum monthly income of €2,700.

The processing time for residency and citizenship applications in Malta varies by status. Applications under the Malta Global Residence Programme typically take 3 to 4 months. For permanent residence, the review process extends from 4 to 6 months.

Investors seeking Malta citizenship for exceptional services by direct investment must first obtain a residence permit, with the option to apply for citizenship after 1 or 3 years.

The Digital Nomad Visa is generally issued within approximately 5 months.

Education and healthcare. Both citizens and foreign nationals holding a residence permit or the Digital Nomad Visa in Malta have access to quality education and healthcare.

Moreover, a Maltese passport enables access to healthcare services and education in any EU country visa-free and often at reduced costs. Conversely, Malta residents require a visa for long-term medical treatment or study in other EU countries.

Taxation. Under the Malta Global Residence Programme, there is a distinct tax regime for participants, which mandates tax payment in Malta as a prerequisite for obtaining a residence permit. Participants are not taxed on foreign income unless it is remitted to Malta, in which case it is subject to a 15% tax rate.

Conversely, investors granted permanent residency or citizenship do not receive any specific tax benefits.

Digital nomads are exempt from paying taxes in Malta, given that their work is conducted outside the country and their income is sourced exclusively from abroad.

How can an investor get Maltese citizenship for exceptional services?

Since 2013, Malta has been issuing passports to investors, but the conditions underwent significant changes in 2020. Now, Malta citizenship can be acquired only through naturalisation for exceptional services by direct investment.

Initially, the investor is granted a residence permit for three years, during which they must pass a rigorous eligibility test. The eligibility to apply for citizenship after either 1 or 3 years is directly contingent upon the scale of their investment. Higher investments may qualify for the shorter waiting period.

Participation requirements. Investors over the age of 18, with no criminal records or visa refusals from countries that have a visa-free agreement with Malta, are eligible to apply for citizenship. Additionally, applicants must not be subject to international sanctions.

Investors can include their spouses, unmarried children under the age of 29, and parents and grandparents aged 55 and above in their citizenship application. To be eligible, children, parents and grandparents must principally depend on the main applicant.

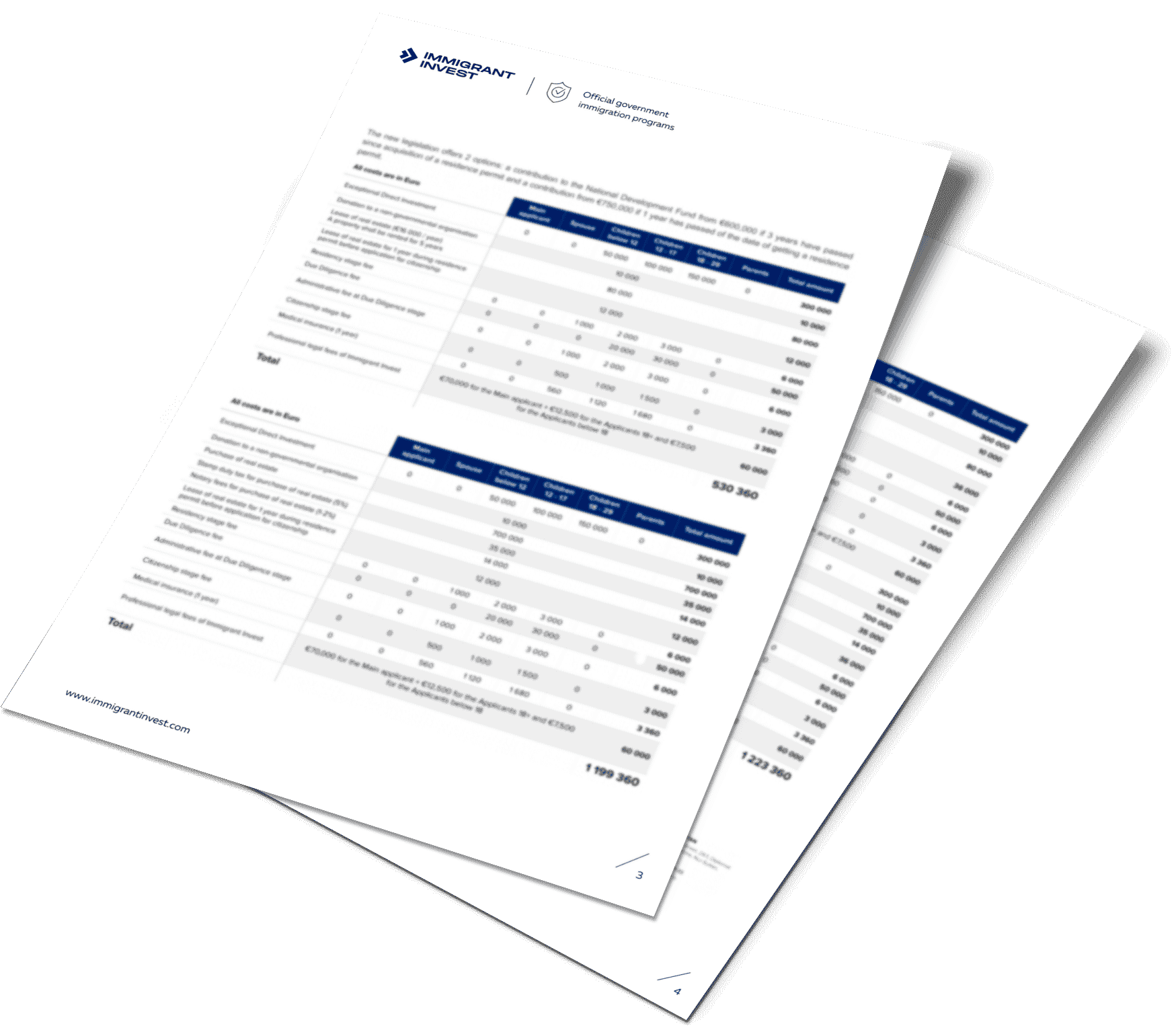

The costs of obtaining Malta citizenship vary based on the chosen investment route and the timeline for acquiring the passport. Investment options include purchasing or leasing real estate.

For investors opting to purchase, the property must be valued at a minimum of €700,000, and they are required to maintain ownership for at least five years post-citizenship acquisition. After this period, they are permitted to sell their properties.

Investors opting to rent real estate as part of their residence permit requirements must secure a lease for an apartment or house with a minimum annual cost of €12,000. Upon obtaining citizenship, they are then required to enter into a new rental agreement for a duration of at least five years, at a minimum annual rent of €16,000.

Investors are required to pay a non-refundable state fee, regardless of the investment path they choose:

- €750,000 for those planning to apply for citizenship after 1 year;

- €600,000 for applications made after 3 years.

Additionally, a fee of €50,000 is applicable for each family member included in the citizenship application.

Obtaining Maltese citizenship incurs other mandatory expenses, including:

- a minimum charitable contribution of €10,000 to a non-governmental organisation in Malta;

- an Eligibility Test fee starting at €15,000;

- a residence card issuance fee of at least €5,000;

- administrative fees beginning at €3,000;

- health insurance coverage at a minimum cost of €500.

Learn the benefits and obtaining terms of Maltese citizenship for investors

Alternative routes to Maltese citizenship. Apart from investment, foreigners may acquire Maltese citizenship by birth, registration, or naturalisation.

Children born to Maltese citizens are eligible for citizenship by birth or descent, with the specific requirements varying based on the individual's birth date.

Foreign nationals married to Maltese citizens for a minimum of five years can apply for citizenship by registration, which is also available to:

- widows and widowers of Maltese nationals;

- children of Maltese citizens;

- direct descendants of an ancestor born in Malta, whose parent was also born in Malta.

Citizenship by naturalisation is obtained by foreigners who have resided in Malta for 12 months before filing an application and at least 4 years during 6 years preceding the period of 12 months. A person eligible for a Maltese passport must know English or Maltese at a sufficient level and be of good character.

How to obtain Malta citizenship for exceptional services by direct investment: a step-by-step guide

The path to Maltese citizenship spans either one or three years, depending on the amount of financial contributions made.

Due diligence is essential when applying for citizenship in Malta. It is pivotal in determining if the Maltese authorities will approve an investor’s application.

The Immigrant Invest’s certified Anti-Money Laundering Officer scrutinises the investor’s documents to pinpoint potential issues that might lead to the application’s denial. The Compliance Department confidentially checks the applicant against global databases.

Should any potential obstacles threaten the success of the application, we explore and suggest alternative pathways to secure second citizenship.

The Maltese police conduct checks on the investor and any family member above 12 against the Interpol and Europol databases.

Investors, along with their family members aged 18 and over, are eligible for a residence permit in Malta. As an authorised agent, Immigrant Invest facilitates this process by:

- preparing a Level 1 Due Diligence report to assess eligibility;

- translating and notarizing required documents for the application;

- signing a lease agreement for property in Malta as part of the residency requirements;

- completing all necessary medical insurance forms;

- submitting the residence permit application on behalf of the investor and their family.

Immigrant Invest manages the preparation and submission of documents for the investor’s Eligibility Test, a crucial step that must be undertaken within 12 months of receiving the Maltese residence permit card.

This mandatory test is required for all applicants over the age of 12, ensuring they meet the specific criteria set by Maltese authorities.

The Minister in charge of Malta citizenship affairs decides on the approval or rejection of applications.

After passing the Eligibility Test, applicants are eligible to obtain citizenship in one or three years after getting a residence permit.

Applicants must notify about any major changes in their situation if applying after 1 year. For example, update the MRQ form in case of severe health conditions.

Those applying after 3 years must confirm their permanent address in Malta and provide a current police clearance certificate. Any changes to documents must also be reported.

The final decision, delivered in writing, authorises the applicant to acquire citizenship.

Following the Minister’s approval, investors are required to meet all investment criteria within four months. Additionally, as mandated by recent legislation, the main applicant must demonstrate their residency in Malta. This involves:

- maintaining a residence permit for 36 months if making an investment of more than €600,000; or

- maintaining a residence permit for 12 months if making an investment exceeding €750,000.

Applicants over 6 must personally collect their passports from the Malta Passport Department.

How can investors get Malta permanent residence?

The Malta Permanent Residence Programme offers high-net-worth individuals the opportunity to obtain permanent residency by investment. Applicants achieve this status by either purchasing or leasing real estate and fulfilling specific fee requirements.

Participation requirements. To qualify for permanent residence in Malta, adult investors must have a clean criminal record and no visa refusals from countries that Malta allows visa-free travel. They must also demonstrate financial stability with a minimum capital of €500,000, including €150,000 in liquid assets.

Investors and their spouses can add principally dependent children, parents, and grandparents to the permanent residence application.

Program expenses. The Malta Permanent Residence Programme requires a minimum investment of €150,000. The main applicant fulfils several conditions, including buying or renting real estate.

For real estate purchases, the minimum investment is €300,000 in the southern region of Malta or on the island of Gozo, and €350,000 in other parts of the country. Additionally, a contribution fee of €28,000 is mandatory for all investors.

Investors opting to lease rather than purchase property must enter into a five-year rental agreement. The minimum annual rent is set at €10,000 for properties located in the southern region of Malta or on the island of Gozo, and at €12,000 for properties in other areas of the country. For investors choosing the rental path, the contribution fee is increased to €58,000.

Independent of the choice between purchasing or leasing property, investors are required to cover the following costs:

- an administration fee of €40,000;

- a charitable donation of €2,000.

Additional expenses include notary and translation fees starting from €4,000, medical insurance starting from €400 per person, and legal support costs.

Application processing timeline. The application for Malta's Permanent Residence status typically takes 4 to 6 months to process. Once granted, the status is permanent, although the residence card must be renewed every five years.

The process Includes:

- preliminary Due Diligence by Immigrant Invest’s lawyers — 1 day;

- collection of documents and submission of the application — up to 5 weeks;

- main Due Diligence phase — up to 6 months;

- fulfilment of investment conditions — up to 8 months;

- fingerprinting in Malta — at least 1 day;

- final approval — 1 month;

- issuance of permanent residence cards — 2 weeks.

For the initial five years, investors are subject to annual reviews by the Residency Malta Agency to ensure ongoing compliance with the programme’s requirements.

Non-investment path to permanent residency. Foreign nationals can qualify for permanent residency (PR) after legally residing in Malta for a minimum of five years on a temporary residence permit.

To be eligible, applicants must meet additional criteria beyond residency:

- demonstrate income at least equal to the Maltese minimum wage, plus an additional 20% for each dependent family member;

- maintain a registered address in Malta that is appropriate for their family size;

- purchase health insurance coverage for each family member;

- pass a proficiency exam in either Maltese or English.

How to get a Maltese residence permit as an investor

The Malta Global Residence Programme offers high-net-worth foreigners the opportunity to obtain a temporary residence permit. This permit is available to investors aiming to become tax residents of Malta. While they are not required to reside in Malta year-round, they must ensure they do not spend more than 183 days annually in any other single country.

Participation requirements. The main applicant must be over 18, from a country outside the EU and the EEA, and have no criminal record. Additionally, investors must confirm a stable income and demonstrate adequate proficiency in either Maltese or English.

Spouses, children under 25, siblings, parents, and grandparents of the main applicant can also obtain residence permits. These family members must be principally dependent on the investor or their spouse.

Program expenses. Participation in the Malta Global Residence Programme requires investments starting at €35,000.

To obtain a residence permit, investors must either purchase or rent real estate in Malta. Additionally, they are responsible for paying an administrative fee and meeting a minimum annual tax requirement of €15,000. This tax is part of the programme's financial obligations to ensure compliance with Malta's tax regulations.

In the south of Malta and on the island of Gozo, program participants have the following options:

- buy a property for at least €220,000 and pay an administrative fee of €5,500;

- rent a property for at least €8,750 a year and pay an administrative fee of €6,000.

In other regions of Malta, the financial requirements for investors increase slightly:

- buy a property for at least €275,000 and pay an administrative fee of €6,000.

- rent a property for at least €9,600 a year and pay an administrative fee of €6,000.

If an investor opts to purchase a property, they are also obligated to cover a one-time property purchase tax, stamp duty, and various special fees associated with the transaction. These total expenses typically range from 8 to 15% of the property's transaction value.

In addition to the property-related costs, participants in the Malta residence permit program must account for other necessary expenses. These include translation and notary services, with fees starting at €4,000, and medical insurance, which begins at €400 per person.

Application processing timeline. The process to obtain a residence permit in Malta takes a minimum of five months.

To obtain a temporary residence permit, the following steps must be completed:

- pass a preliminary Due Diligence check conducted by Immigrant Invest’s lawyers — 1 day;

- collect documents and apply to the tax service — up to 5 weeks;

- undergo a main Due Diligence process — up to 4 months;

- obtain a special tax status — at least 2 weeks;

- apply for the residence permit and complete fingerprinting — at least 2 weeks;

- receive the residence permit card — up to 7 weeks.

Initially, the permit is issued for a duration of one year. Upon renewal, subsequent permits are valid for two years each.

Other ways to obtain a Malta residence permit. A foreigner may be eligible for a residence permit if they are:

- employed in Malta;

- self-employed;

- studying at a Maltese university;

- conducting research;

- a family member of a Maltese citizen.

Additionally, there are specific categories that also qualify for residence permits, such as volunteers, trainees, or international service providers.

How to obtain a Malta residence permit as a digital nomad?

The Malta Nomad Residence Permit is granted to freelancers or remote workers who must not work locally and should earn their income from outside Malta. It allows for a stay of up to 3 years.

Participation requirements. The applicant must have a monthly income of at least €2,700 from outside Malta. Eligible applicants include employees of foreign companies, directors of companies registered outside Malta, freelancers, or self-employed individuals.

In addition to having sufficient income, the applicant is also required to rent or buy residential property, with no minimum cost stipulation.

Applicants must be over 18, have no criminal record, and hail from non-EU and non-EEA countries. They may include their spouse or partner, minor children, and principally dependent children over 18 in their application. The applicant and all family members must possess health insurance.

Application processing timeline. The application process typically extends over 5 months and includes the following steps:

- preliminary Due Diligence by Immigrant Invest’s lawyers — 1 day;

- document preparation — at least 1 week;

- submission of the application along with the fee payment — at least 1 week;

- preliminary approval — at least 1 month;

- a trip to Malta — 2 to 3 weeks;

- confirmation of an address in Malta and purchase of health insurance — up to 30 days;

- collection of the residence permit cards — 2 to 3 weeks.

The residence permit for digital nomads is valid for one year and may be renewed twice for an equivalent duration. To retain this status, the applicant is required to spend a minimum of five months per year in Malta.

Benefits of Malta citizenship and residency

Malta boasts a warm climate, affordable living, high-quality healthcare, and European-standard education, enhancing its attractiveness as a residency choice.

Malta citizenship offers several advantages:

- freedom to live in Malta or another EU country with simplified relocation procedures;

- visa-free travel to 169 countries, including the Schengen Area, the UK, the US, Canada, and Australia;

- the ability to work and do business in Malta and the EU without special permits;

- access to healthcare and education across Malta and the EU for investors and their families.

Permanent residence in Malta, valid for life, shares many benefits with temporary residency, minus the need for permanent in-country residence. It allows free travel within the Schengen Area and access to local services without special tax incentives.

Temporary residence permits enable living, studying, and working in Malta and visa-free Schengen Area access. Tax residency in Malta under a special regime includes:

- No tax on foreign income not remitted to Malta.

- A 15% tax on remitted foreign income.

- A 35% tax on Malta-sourced income, with a minimum annual tax of €15,000 per family.

Comparison: citizenship vs residency in Malta

| Comparison criteria | Digital Nomad Visa | Residence permit | Permanent residence | Citizenship |

| Costs | €2,700+ a month | €35,000+ | €150,000+ | €690,000+ |

| Obtainment period | 5+ months | 5+ months | 6—8 months | 1 or 3 years |

| Residency requirement | 5+ months | No more than 183 days a year in another country | None | None |

| Validity period | 1 year, twice extendable | 1 year, then 2 years | Lifetime | Lifetime |

Key takeouts

- In Malta, foreigners can obtain various statuses: citizenship for exceptional services by direct investment, permanent or temporary residence by investment, or a Digital Nomad Visa.

- To acquire citizenship, a foreigner must first obtain a residence permit, meet the investment threshold of over €690,000, and apply for citizenship after 1 or 3 years.

- Permanent residency is available to individuals investing over €150,000 and demonstrating a minimum capital of €500,000.

- Temporary residency is awarded to foreigners who purchase or rent property, pay an administrative fee, and meet the minimum annual tax requirement of €15,000.

- Remote workers or freelancers with a monthly income of at least €2,700 are eligible for the Digital Nomad Visa.

Frequently Asked Questions

Foreigners can take part in government programs.

Malta temporary residence works best for foreigners who want to become tax residents of the country. Paying taxes in Malta under a special regime is the main condition of the program. To get a residence permit, applicants must buy or rent a property and pay an administrative fee and a minimum annual tax of €15,000.

Malta permanent residence is more often obtained by investors who plan to move to the country, conduct international business, and travel visa-free to the countries of the Schengen Area for 90 days out of 180.

The status is issued for life. To get permanent residence, investors must buy or rent real estate and pay fees and charges.

By naturalisation for exceptional services by direct investment. To do this, investors first get a residence permit, and after 1 or 3 years, they apply for citizenship.

A licensed agent submits an Eligibility Test application within one year of obtaining a residence permit. The fee is €15,000 for the investor and €10,000 for each family member over 12.

When applying for Malta citizenship, investors must buy or rent property in the country, pay government and administrative fees, and make charitable donations.

Global Residence Programme is a residence permit program in Malta for affluent people who want to optimise taxes through a special regime. At the same time, investors do not have to move to Malta; they need to spend no more than 183 days in another country.

As residents of Malta, investors have the right to access local hospitals, banks and educational institutions, as well as travel around the Schengen Area without a visa.

Malta permanent residence status allows investors to stay in Malta at any time, work, conduct business, and use the services of clinics and banks here. Investors can provide children with a high-quality education: schools and universities in Malta are based on European standards.

Malta’s permanent residence card provides visa-free access to other Schengen countries, with permission to spend up to 90 days out of 180 a year there.

An investor with a Maltese passport gets the right to live, work and study in Malta or another EU country. Also, a Malta passport provides visa-free access to 187 countries worldwide.

Foreigners who obtain Malta citizenship by naturalisation for exceptional services by direct investment get residency for three years. They also undergo the strict Eligibility Test. They can apply for citizenship only after 1 or 3 years as a resident.

The only way, in this case, is to get citizenship by naturalisation for exceptional services by direct investment. Applicants first acquire a residence permit, pass the Eligibility Test, and after 1 or 3 years, apply for citizenship.

Expenses depend on a chosen investment option and when they plan to get the passport. The options include buying or renting real estate.

Igor Buglo

Head of the Maltese office, MBA

Igor Buglo

Head of the Maltese office, MBA