What is a Digital Nomad visa to Malta?

The Digital Nomad visa allows foreigners who work remotely to obtain a residence permit in Malta. The fields of activity can vary widely, including but not limited to programming, design, consulting, and management.

To qualify as a digital nomad and get the visa, a foreigner has to fall under one of the categories:

- A full-time employee of a foreign company, working remotely.

- A managing partner or shareholder of a foreign company.

- A freelancer who provides services to clients outside Malta.

A residence permit is issued to citizens of states that are not part of the European Union, European Economic Area, or Switzerland. For example, this means that citizens of countries like Canada are eligible to apply.

The institution responsible for processing applications and issuing visas is called the Residency Malta Agency.

Working and conducting business in Malta is not allowed with a residence permit for digital nomads. All of the resident’s income has to come from foreign sources only.

A total of 4 years is the maximum amount of time one can reside in Malta with a Digital Nomad visa. The residence card is issued for a year and can be extended for the same period thrice.

It is enough to spend 5 out of 12 months in Malta in total to extend the residence permit. This allows a digital nomad to maintain tax residency in their home country and avoid double taxation. Should a resident spend more than 183 days in Malta during the year, they become liable for taxation on their global income both in Malta and in their country of income.

A digital nomad’s residence permit is not a path to permanent residency. To be eligible for permanent residency or citizenship, one has to legally live in Malta for at least 5 years on the basis of a different residence permit. Years spent in Malta with a digital nomad’s permit are not taken into account for issuing permanent residence or citizenship.

Investors can obtain a life-long residency status with the Malta Permanent Residence Programme in 4—6 months. Applicants buy or rent real estate, pay state fees and make a charitable donation to a non-governmental organisation.

Who can obtain a Digital Nomad visa to Malta?

To apply for the Nomad Residence Permit, an applicant has to be over 18 years old and confirm that they earn money from remote work for companies outside Malta.

The minimum yearly pre-tax income for a residence permit is €42,000. Applicants must also verify their income source for the next 5 months by providing a valid employment contract with salary details or a service contract.

Along with the digital nomad, their family members can apply for a residence permit and move to Malta. This applies to:

- spouse, including those in an unregistered or same-sex marriage;

- children under 18 years, including adopted children;

- children over 18 years without their own sources of income.

The family may apply for a residence permit simultaneously with the main applicant or receive the residence permit later. Family composition does not affect the digital nomad’s required income.

Step-by-step procedure for obtaining a Nomad Residence Permit in Malta

The application for a residence permit is submitted by email to the Residency Malta Agency. Applicants receive notifications of approval or refusal by email.

The applicant collects the documents and gets them apostilled, translated and notarized. The basic list of required papers includes:

- the main applicant’s and their family members’ application forms;

- motivation letter explaining why the foreigner wants to move to Malta;

- passport or other international travel document;

- for remote employees — a contract of employment clearly stating that the work can be done remotely;

- for freelancers — a contract for remote provision of services;

- for entrepreneurs and managing partners of foreign companies — documents that confirm official powers and ownership of a share in the company;

- CV describing places of work and studies in chronological order;

- bank statement, which confirms annual income of at least 42,000 €;

- marriage certificate or proof of unregistered marriage;

- children’s birth certificates;

- notarized proof of financial dependency for children over 18 years of age.

The applicant sends the documents to the Malta Immigration Agency by email: [email protected].

The agency verifies that the applicant has submitted all the required documents and sends an invoice for the application fee of €300.

The applicant pays the fee, and the agency accepts the residence permit application for processing.

The Malta Immigration Agency checks whether the applicant complies with the visa requirements and assesses if the candidate poses a threat to national security and public order.

Reasons for refusal of a residence permit may include a criminal record, previous Schengen visa refusals, entry ban or legal problems in any of the Schengen states.

The agency sends a preliminary approval or refusal. In case of refusal, the agency is not required to name a reason. Reapplication is possible at least a year after refusal.

The applicant has to buy or rent accommodation in Malta. To apply, it is enough to book a hotel or apartment through online services. When the residence permit is approved, the applicant rents accommodation for at least one year — the validity period of the residence permit card. The applicant can also purchase real estate.

The foreigner buys health insurance for themselves and all family members in the application. The amount of coverage under the insurance must be at least 30,000 € per person.

The applicant can apply for a residence permit only in person in Malta. To enter the country, they can obtain a tourist Schengen visa or a national type D visa.

The applicant arrives in Malta and notifies the Immigration Agency of their arrival by email. The Agency schedules an appointment for the digital nomad to submit their fingerprints and apply for a residence permit card. The fee for the issuance of the card is 27.5 € per person.

When the residence card is ready, the Agency notifies the applicant and informs them where they can pick it up. The applicant and their family members can receive the document only in person.

5 Benefits of the Digital Nomad visa to Malta

1. Allows living in Malta for up to 4 years. A residence permit is issued for one year and can be renewed thrice for the same period.

2. Straightforward application process. Digital nomads can apply for the visa online without having to visit the embassy and stand in line.

3. Residence for the whole family. The main applicant can provide close family members with residency permits as well. This applies to spouses and long-term partners, children under 18 years old and financially dependent adult children.

4. Visa-free travel to Schengen. A residence permit in Malta allows its owner to enter other countries in the Schengen Area and spend up to 90 days every half a year.

5. No obligation to pay taxes. A digital nomad does not have to pay taxes in Malta as long as they don’t become tax residents of the country. One becomes a tax resident in Malta only after they spend more than 183 days a year there.

Life in Malta as a digital nomad

Malta attracts foreigners with its Mediterranean climate, comfort and relatively low cost of living.

The cost of living in Malta is lower than in Germany or Austria but higher than in Spain and Portugal. To live comfortably in Malta, a single person needs around €800, excluding rent. Renting a 1-bedroom apartment in Malta costs an average of €600 per month, and a larger 3-bedroom apartment costs €950 per month.

Approximate expenses for everyday needs in Malta are:

- cell phone service — €20 per month;

- single travel pass — €26 per month;

- Co-working — €30 per day;

- cappuccino — €2,25;

- local beer — €3.

A digital nomad does not have to pay taxes in Malta on their foreign income if they spend less than half a year in the country.

The obligation to pay taxes in Malta arises if one lives in the country for more than 183 days a year. In this case, it is necessary to pay taxes on the foreign income both in Malta and in the country of income. For example, if a digital nomad works remotely for a company in Canada and lives in Malta, they are liable to pay tax in both Canada and Malta.

Digital nomads who become Maltese tax residents benefit from a favourable tax structure, paying a flat income tax rate of 10% — significantly lower than the progressive rates for other Maltese residents, which can climb up to 35% based on global income. Furthermore, digital nomads enjoy a tax exemption for their first year, allowing them to fully settle in without the immediate burden of income tax.

English is the official language of Malta, along with Maltese. Most residents in Malta speak English among themselves. A foreigner only needs to know conversational English to communicate with locals, doctors or government officials.

Lifestyle. A digital nomad can choose the busy tourist areas in Valletta, Sliema, St. Julians or the quieter South West Coast and Gozo Island.

Nomads can work in cafes with free wifi or rent a coworking space. It’s possible to rent a coworking space for a day or a month at a time and choose a dedicated workspace or get a non-fixed one. One can also rent a separate office room in a coworking space.

During their free time, digital nomads can relax on the beach, scuba dive, sail, or explore historical sights.

Transportation. A car is not a necessity in Malta because public transportation is well-developed. Residents take buses or ferries to move around cities or neighbouring towns.

Climate. The average temperature is +27॰С in summer and +15॰С in winter. The sea warms up to +23...+25॰С in summer. It is rarely cloudy in Malta — there are 300 sunny days a year.

How to live in Malta as a digital nomad for longer than 4 years

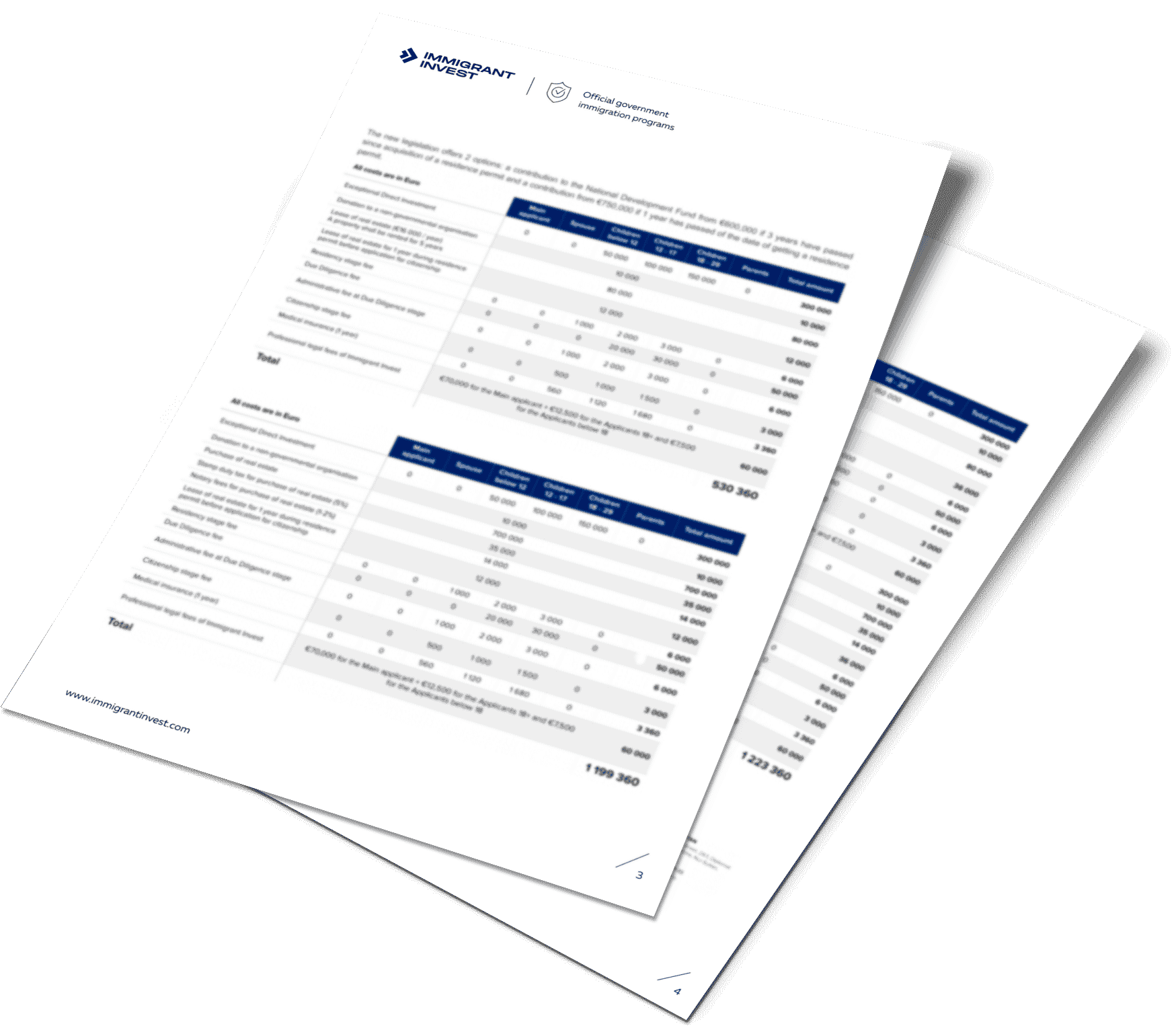

The easiest and fastest way to obtain residency in Malta is to buy or rent real estate. The minimum required investment is:

- €34,150 in case of rent;

- €270,200 in case of purchase.

The costs of a residence permit include a mandatory non-refundable administrative fee for the program, taxes on the purchase of the real estate, health insurance, as well as translation and notarization of documents.

The holder of a residence permit in Malta for investors is obliged to pay tax on foreign income of at least €15,000 per year. The residence permit can be renewed any number of times as long as the foreigner fulfils the conditions of the program.

Foreigners are granted indefinite permanent residence in Malta for investments of at least €150,000.

What is the difference between a Digital Nomad visa and a tourist visa in Malta?

The residence permit for digital nomads is granted on the basis of a national type D visa. A residence permit holder has more rights in the country and can stay for longer than tourist visa holders.

| Comparison criteria | Digital Nomad Visa | Tourist visa |

| Duration of stay | Up to 4 years | Up to 90 days |

| Extension conditions | Does not require leaving the country | The holder has to leave the country to extend the visa |

| Permission to work remotely | Allows working remotely for foreign companies | Does not allow any work |

| Free entry to other Schengen states | Unlimited stay in Malta and for up to 90 days out of 180 in other Schengen countries | For up to 90 days out of 180 in total in all Schengen states, including Malta |

Key takeaways on Malta Nomad Residence Permit

- A digital nomad in Malta is a foreigner who works remotely and earns income from abroad: full-time employee, freelancer, director of his own company or managing partner or shareholder.

- The minimum income for a Nomad Residence Permit in Malta is €42,000 per annum before taxes. It is necessary to prove the source of income for the upcoming 5 months — provide a valid employment contract or service contract.

- The residence permit is issued for one year and can be renewed three times for one year each time. One can live in Malta with a digital nomad residence permit for a maximum of 4 years. Along with the main applicant, the residence permit is granted to their spouse and children.

- An applicant for a residence permit must rent or buy a property in Malta and purchase a health insurance policy for all family members. Buyers of real estate and long-term tenants can also receive permanent residency in Malta.

- Application for a digital nomad's residence permit is submitted by email to the Malta Immigration Agency. Residence permit cards are received in person in Malta.

Frequently asked questions

The Nomad Residence Permit allows living in Malta and working remotely for one year. This type of residence permit can be obtained by full-time employees of companies outside Malta, freelancers, directors of foreign companies and managing partners. The minimum annual income required for the visa is €42,000.

The Nomad Residence Permit itself does not oblige the holder to pay taxes in Malta. The digital nomad will have to pay taxes in Malta only if they spend more than 183 days a year.

A foreigner with a Nomad Residence Permit can only earn income from outside Malta: the visa does not allow the holder to work, provide services or run a business in Malta.

To qualify for a Malta Digital Nomad visa, applicants must demonstrate a pre-tax annual income of at least €42,000.

The Nomad Residence Permit is issued for one year. It can be extended thrice for the same period. Thus, the maximum number of years one can spend in Malta with a Nomad Residence Permit is 4 years.

Yes, Malta is a good location for digital nomads.

The country has a special Digital Nomad visa designed specifically for remote workers and freelancers looking to relocate to Malta. The visa allows for obtaining a residence permit valid for one year, which can be extended twice for the same amount of time.

No, the Digital Nomad visa does not allow receiving any income within Malta. To be able to work in Malta, a foreigner should obtain a different residence permit. For example, permanent residence in Malta allows working and doing business in the country.

Expats are drawn to Malta due to its high quality of life and relatively low costs. English is widely spoken in the country, as it is its second national language. The infrastructure is well-developed: free high-speed wi-fi is widely available in coffee shops and coworking spaces.

The Malta digital nomad visa entitles the holder to visa-free travel within the Schengen states. The digital nomad can spend up to 90 days in other Schengen states every 180-day period. The time of stay in Malta is not limited.

The digital nomad visa is issued by Malta and other EU states, such as Cyprus. In total, 30 states in the world offer foreigners similar residence permits.

A digital nomad is a foreigner who earns income from remote work outside Malta. Digital Nomad visa to Malta is granted to full-time employees of non-Maltese companies, freelancers, directors of their own companies and managing partners.

A digital nomad in Malta is a foreigner who earns income from working remotely in another country. A digital nomad can be a full-time employee of a non-Maltese company or a freelancer. It is not necessary to work in the digital field: directors and managing shareholders of foreign businesses are also considered digital nomads.

One can obtain a digital nomad visa in Malta with the help of law firms that specialise in international migration law. If the company conducts a preliminary Due Diligence check, this will reduce the risk of rejection to almost zero. It is recommended to contact agents accredited by the Maltese government.